child tax portal says not eligible

Where are you currently located. The Child Tax Credit Update Portal is no longer available.

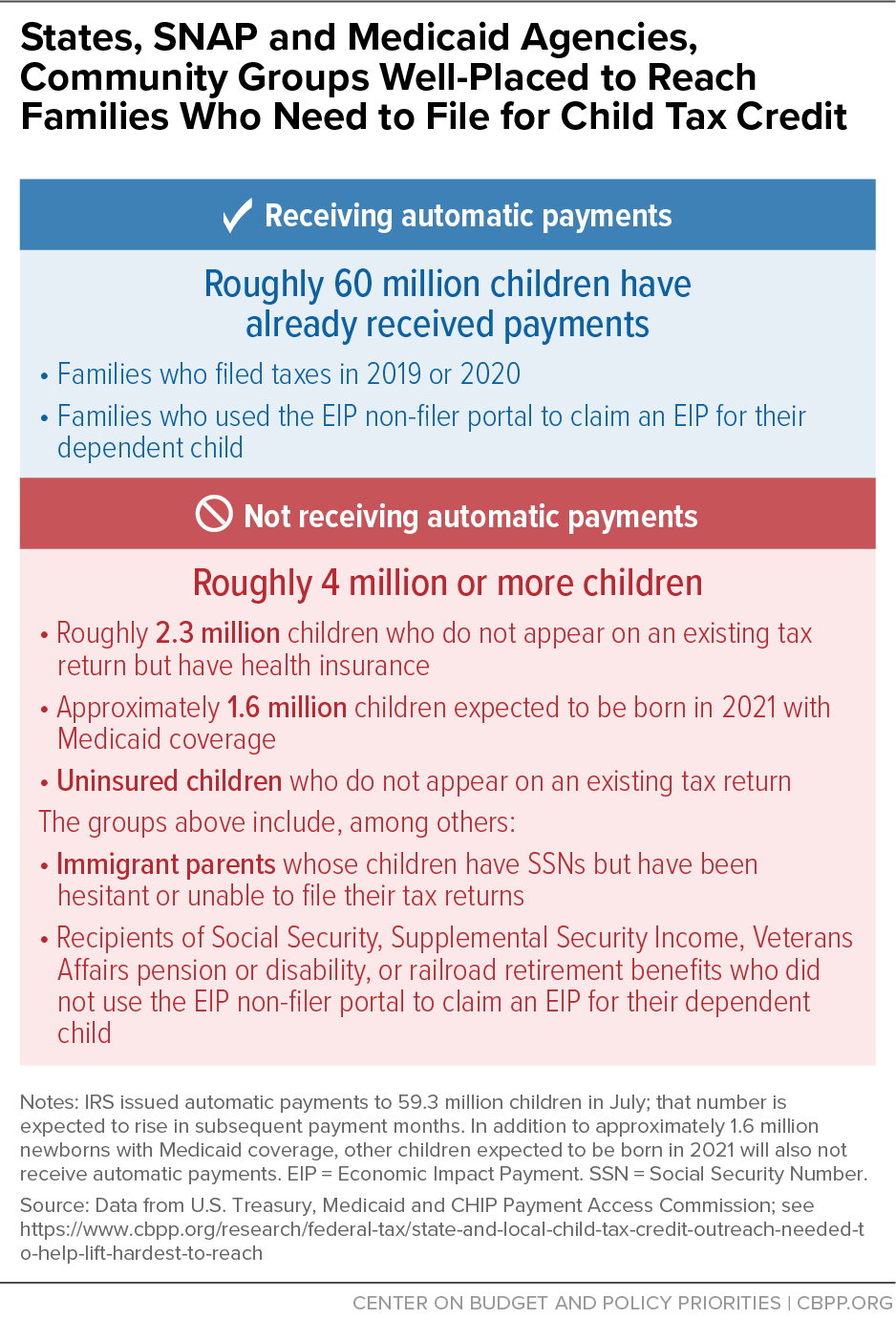

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Through irs web site I am not eligible.

. The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User Your 2021 Baby Makes You Eligible for the Child Tax Credit Find. I got my child tax credit. On the portal it says that shes not eligible I called the IRS.

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. To qualify for the Child Tax Credit your child must fit all of these requirements. 14 hours agoParents can receive up to 3600 per child under six-years-old and 3000 per child under 18.

The Child Tax Credit Update Portal is no longer available. How the Child Tax Credit Will Affect Your 2021 Taxes Additionally you and your child must be US. Same house just me 40000 a year.

Your 2021 Baby Makes You Eligible for the Child Tax Credit Find. The Accountant can help. The IRS website says Im not eligible for the child tax credit and I do believe I am.

I have 3 children under 15. Is your son daughter stepchild foster child. I have looked it up on line and keep coming up with the 8812.

Filed a 2019 or 2020 tax return and claimed the Child Tax. 9 Reasons You Didnt Receive the Child Tax Credit Payment If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Be under age 17 at the end of the tax year. On portal says not eligible I made under 55k filed - Answered by a verified Tax Professional We use cookies to. But my fiance didnt we both filed our 2020 taxes each clamied a kid under 5 years old filed separately.

If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during. Eligible families still have up to three years after the first due date to receive.

Real Estate With Ro Roshondarealtor Twitter

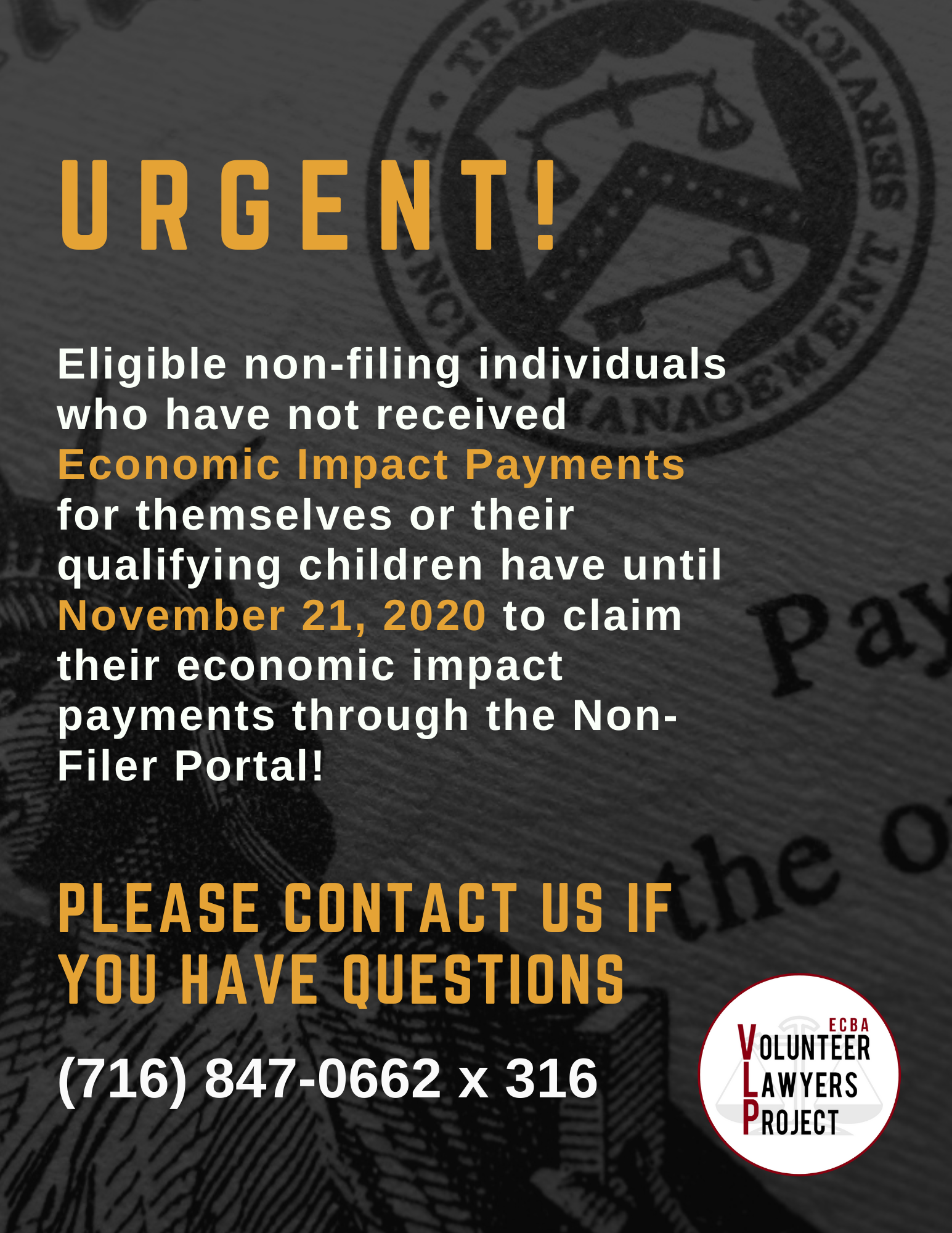

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Low Income Taxpayer Clinic Ecba Volunteer Lawyers Project

The Latest Updates On The Child Tax Credit

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition

Child Tax Credit Schedule 8812 H R Block

Covid Related Tax Resources The Cpa Journal

Frequently Asked Questions On The Child Tax Credit Children S Defense Fund

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit United States Wikipedia

How And When To Opt Out Of Monthly Child Tax Credit Payments Kiplinger

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Child Tax Credit Here S How To Collect Your Monthly Payments Bankrate

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit When Will Your 3 000 Or 3 600 Arrive And Who S Eligible

Not Everyone Received Child Tax Credit Payments About Saverlife

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post